Washington

Government Printing Office

1917

TABLE OF CONTENTS | |

|---|---|

| Page | |

| Earnings, expenses, and dividends | 5 |

| Business and banking conditions in district | 5 |

| Discount operations | 7-9 |

| Acceptances | 10 |

| United States bond transactions | 10 |

| Municipal warrants purchased | 11 |

| Changes in membership due to transfers from and to other districts | 11 |

| Relations with national banks, State banks, and trust companies | 12 |

| Examinations of member banks | 13 |

| Relations with the public | 14 |

| Relations with the government | 15 |

| Federal Reserve note issues | 16 |

| Internal management of the bank | 18-20 |

| Election of directors | 19 |

| Examinations of the bank | 22 |

| Clearings and collections | 22-27 |

| Gold settlement fund | 27 |

| Summary | 28 |

| Shipments of currency and coin | 29 |

EXHIBITS | |

| A. Earnings and expenses | 30 |

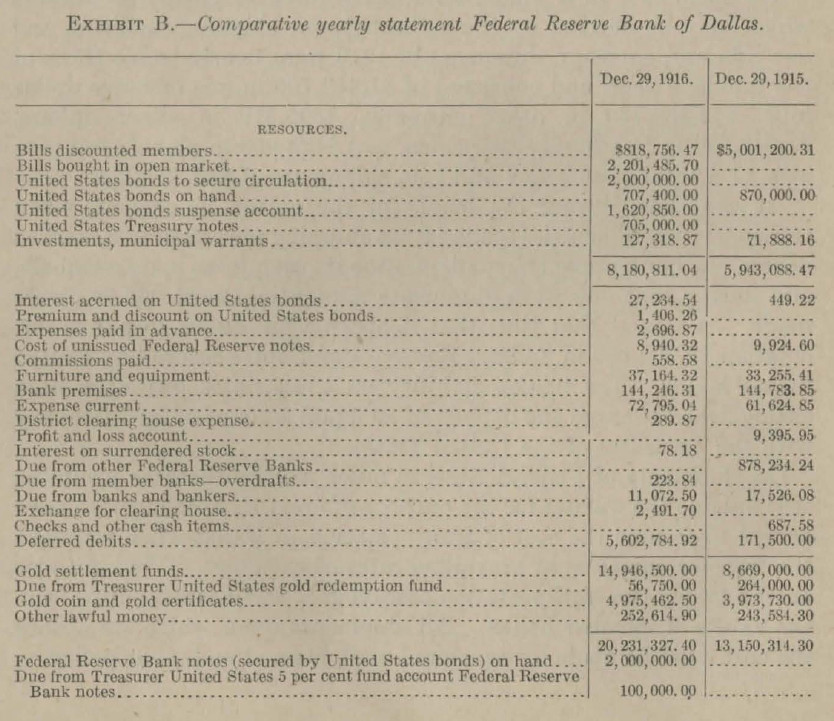

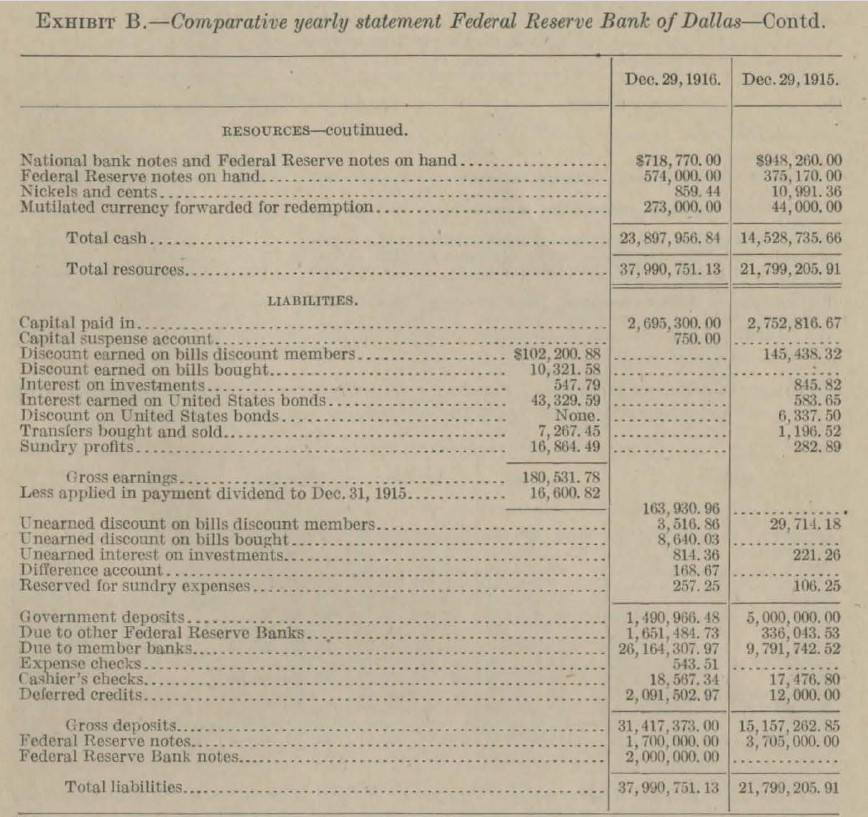

| B. Resources and liabilities | 30 |

| C. Discount operations for year | 31 |

| D. Rediscounts, by maturities, handled | 31 |

| E. Acceptances discounted and bought | 31 |

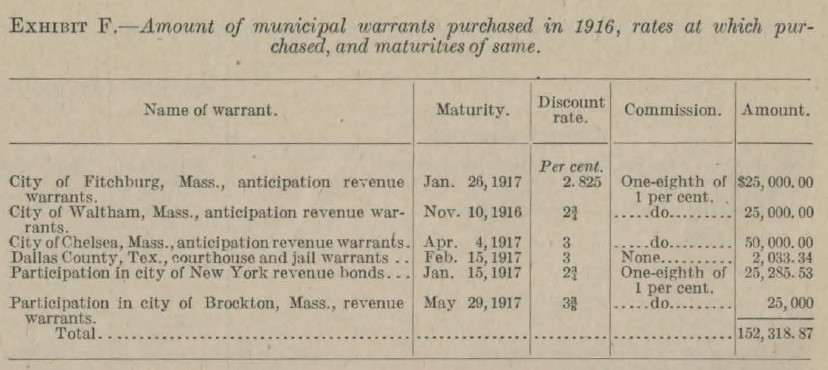

| F. Municipal warrants purchased | 32 |

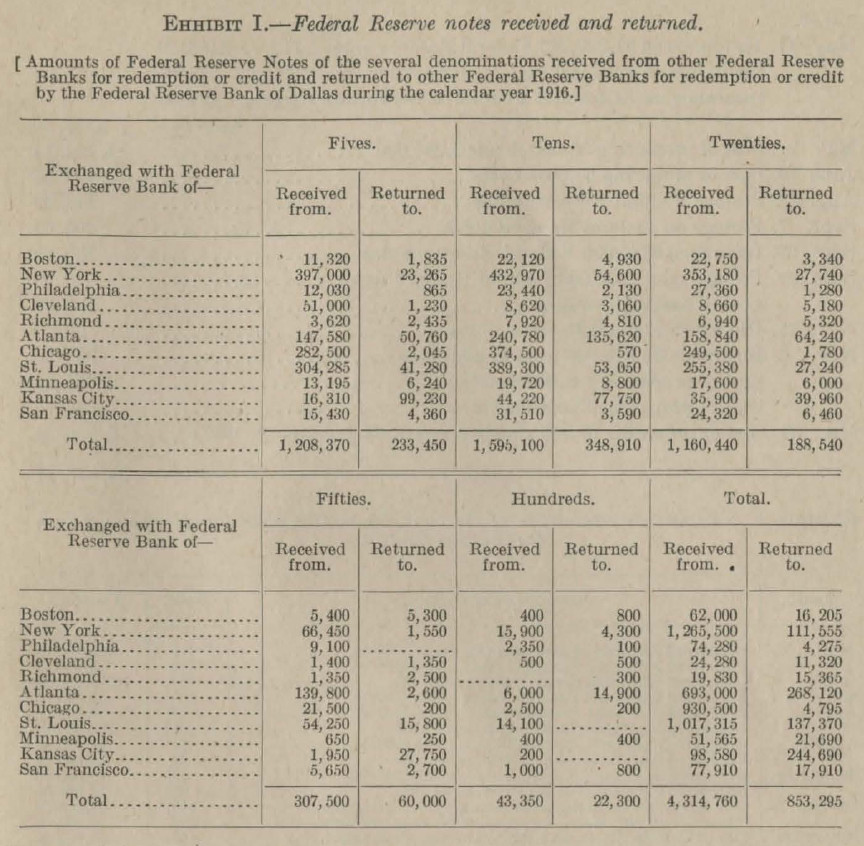

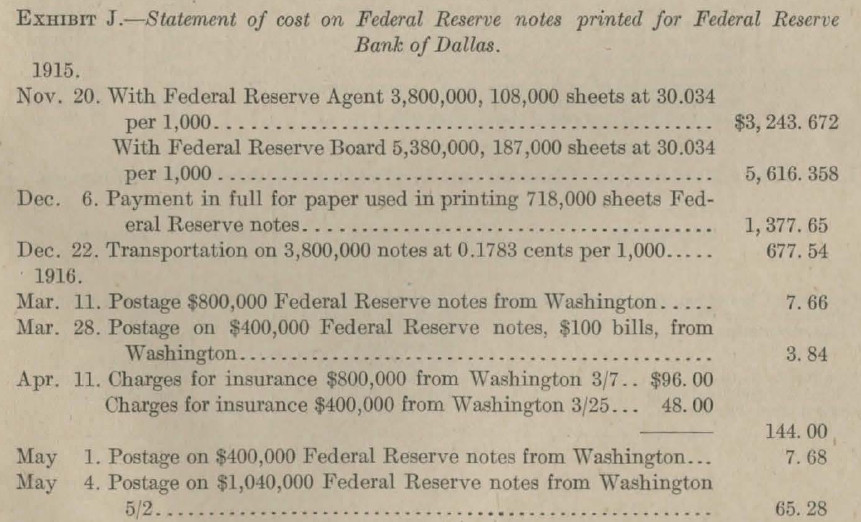

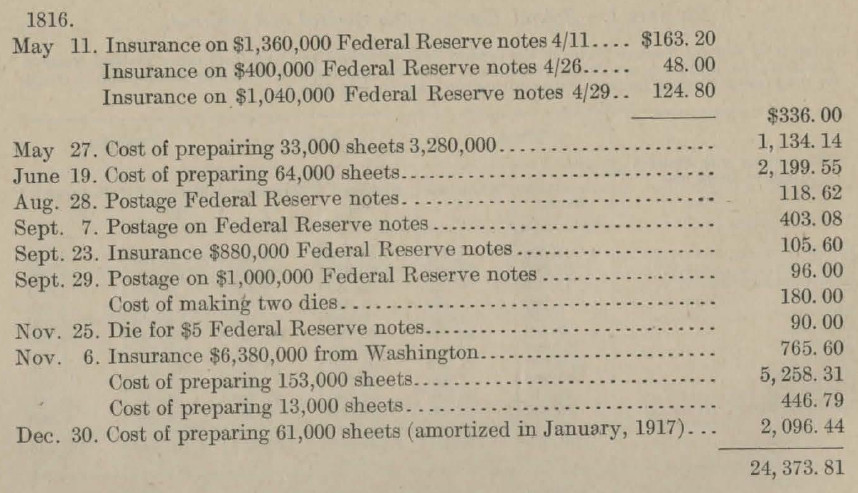

| H, I, J. Federal Reserve note issues | 32-34 |

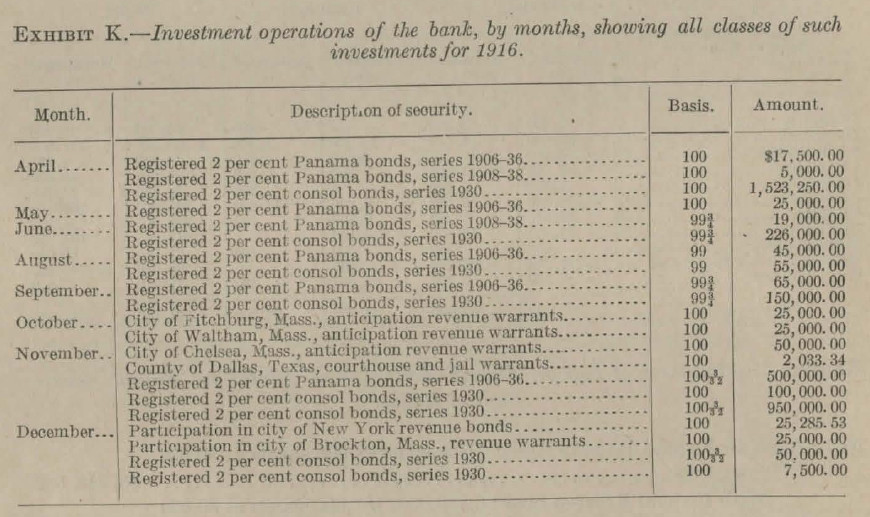

| K. Investment operations of the bank | 34 |

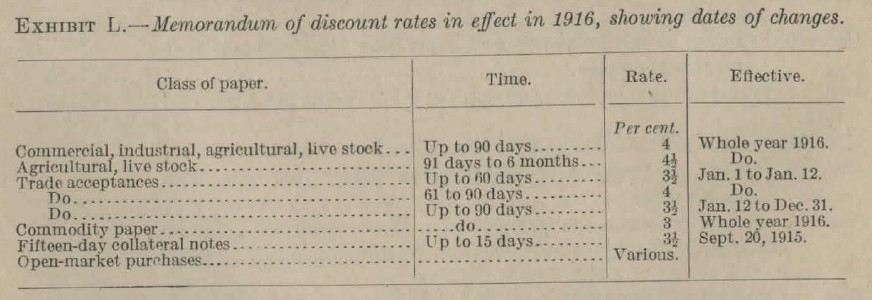

| L. Discount rates | 34 |

While Federal Reserve Banks were not organized for profit-a consideration always held to be subsidiary to the benefit of the system, and in no sense a test of its usefulness-it is gratifying to report that the Federal Reserve Bank of Dallas has made good headway in this respect, and has paid its members a dividend at the rate of 6 per cent per annum from the date of the capital stock payments, at the organization of the bank, to April30, 1916. On January 7, .1916, our board of directors declared a dividend at the rate of 6 per cent per annum from the opening of the bank to June 30, 1915, and on September 15 declared another dividend at the rate of 6 per cent per annum covering the operations to December 31, 1915. On November 28, 1916, the board declared a third dividend of 6 per cent per annum to and including April 30, 1916, payable December 30, 1916. Afer paying these dividends, there was sufficient margin left in the profit account to take care of any depreciation of furniture and fixtures, bank building, etc.

There are attached hereto Exhibit A, Statement showing earnings and expenses of tho bank for the year 1916 and since organization and Exhibit B, Comparative balance sheets for December 31, 1915-16.

GENERAL BUSINESS AND BANKING CONDITIONS IN THE DISTRICT.

Trade conditions in the eleventh district are, almost without exception, all that could be desired and more than could reasonably be hoped for. Crops in most parts of the district were good. The production of wheat, never large, considering the size of Texas, was scarcely up to the average, but the quality of the grain was excellent and its price very high. Corn and hay crops were about average and sufficient for home consumption. The rice crop was better than usual, with very attractive prices. There has been some depression in the lumber trade, a little slowing down of production, and even more slowing down in sales, due in part to car shortage and somewhat more to interference with export business. The livestock industry has prospered, although there is just now a tendency to lower prices of both cattle and sheep, which, while gratifying to the consumer, is not at all comforting to tho producer. Both wool and mohair have borne high prices, and the volume of trade in both articles has been well above the average in other years. Mining in the western part of the district has been conducted on a very large scale and the copper mines have been profitable beyond any precedent in previous years. Production of petroleum during the past year has remained about stationary, but prices have been high and returns large. The factor of controlling and overshadowing importance has been the very large crop of cotton produced in this district. In the territory covered by Texas and the portions of Louisiana and Oklahoma comprised in this district the crop for the current year will not be less than 4,000,000 bales, of a value in money (including seed) of but little less, if any, than $400,000,000. This has given, in connection with the other features noted above, a prosperity to this district which has never before been known. A cause contributing to the present prosperity of the district has been the close and rigid economy with which the crop was produced. Another most gratifying factor of the whole situation is the fact that thisprosperity is very widely and generally distributed over a very great portion of the district and somewhnt evenly nmong all classes and grades of farmers.

The conditions above noted have found reflection in very generally increased deposits in all the banks of this section. Detailed figures are not available at this time, but on October 16 of this year the increa:se in deposits of member banks in the reserve city banks of Dallas, Fort Worth, Waco, San Antonio, Houston, and Galveston, over like figures for a corresponding date in 1915, amounted to more than $80,000,000, and in Dullas alone there had been an increase of more than $25,000,000. In Houston there had been an even larger increase. According to conservative estimates the gain in all the banks in the State within a year has been approximately 70 per cent. With such an immensely increased purchasing power the improvement in both retail and wholesale trade which has followed would be expected. In postal receipts a considerable increase has been observed in all the principal cities and towns of the State, and it is a fair inference that similar increases will be found in the smaller towns and villages. All the clearing houses in the State show remarkable increases. There has as yet been no considerable gain in building permits, and real estate is so far showing little activity. The large increase in the cost of living has attracted attention and has undoubtedly worked great hardship on the laboring classes and generally on persons with fixed incomes derived from personal services, or dependent on rents or interest on moneys and dividends from stocks and bonds. Labor, both skilled and unskilled, has been and is well employed in practically all lines and in most, if not all, parts of the district. We have been immune from strikes or lockouts and there is generally a very friendly feeling between capital and labor. It is believed that the present season of prosperity will continue throughout the current year without serious diminution. It should, and we believe will, find expression in better housing and a broader and more generous investment in articles and merchandise which make for more comfort in the home. The coming year will beyond doubt witness large investments in farming lands which have shown soma depreciation since the beginning of the present European war, with the expected result of an appreciable stiffening of the price of such properties.

The situation of the banks is both unusual and fortunate We have witnessed and are witnessing a period of increasing deposits without a parallel and a time of liquidation without a precedent. All the banks have increased their cash reserves. There has been a considerable softening of interest rates. The promise of immediate profits is not inviting. Some of the banks are buying commercial paper, but, as a rule, in moderate amounts and only of the highest grade. In a situation provocative of extravagance and inflation it is indeed a pleasure to be able to chronicle a very general attitude of conservative waiting and practice. Our own judgment is that with the beginning of 1917 there will be such a broad revival of legitimate trade and industry as will bring into requisition a large amount of the funds of the banks at fair rates and in legitimate as well as profitable lines of endeavor.

The operations of this bank in the main have been very satisfactory. The attitude of our member banks is one of cordial good will, with but few exceptions. There is a more general disposition to cooperate with us than seemed apparent even in the beginning of the year. Our business has brought us into very close personal touch with most of them. Within the past two years we have at different times rediscounted paper for more than 400 of the 621 member banks in the district to an amount aggregating $46,000,000. Our banks appreciate our efforts to promote their wellare and have given us the strongest assurance of their cordial good will and their promise of active and friendly cooperation.

Discount operations of the bank have steadily grown, and, as indicating the extent to which we have served our member banks during the past year, there is attached a statement (Exhibit C) showing the total number of banks accommodated, the total amount of rediscounts accepted, as well as the number of new banks which we have served in 1916. All offerings have had the attention of our executive committee, after careful analyses of credit statements and eligibility of the paper, by our credit information department. It has been the policy of the officers of this bank, both by correspondence and personal contact, to explain the workings of our discount machinery, and in every way possible to assist our member banks in taking advantage of this service, and to impress upon them the fact that where the paper was eligible for rediscount under our regulations, it was a comparatively easy matter to make use of our facilities. Our member banks have gradually become familiar with our methods, and the amount of paper returned, because of failure to meet the requirements of our executive committee, has been negligible.

The year just closed has afforded a fair opportunity for testing the discount operations of the Federal Reserve Bank. It can hardly be said to have been such a year as to put the system to the supreme test, yet it haa fully demonstrated the service which the Federal Reserve Banks are capable of rendering and their ability to stabilize financial conditions. There is no doubt that this fact is appreciated by a majority of our member banks, and the passing year has cemented the friendly relations already existing between this institution and its members.

Changiug seasons and conditions naturally produced fluctuations in our discount operations. The height of our discounting season was reached on September 6, when bills discounted and bought held by this bank aggregated $8,291,647.03, classified as follows:

| Bills bought in the open market | $649,292.00 |

| Bills discounted-members | 7,642,355.03 |

Our discounting operations at this date were the largest in the history of the bank. The crop moved very rapidly, however, and when liquidation commenced the demand became light, until on December 2 our loans were at the minimum figure of $2,421,928.31.

There has been no occasion to make any extensive changes in our discount rates in the past year. There has been no change in the rates on commercial paper, as demand has always been sufficient to warrant the present rat.es, and on account of the comparatively easy conditions prevailing there seemed to be no necessity for raising the same.

There is attached hereto (marked Exhibit D) a table showing the amounts of paper discounted in 1916, classified by maturities.

On account of the excellent prices obtaining for cotton and farm products in this district during the past season these commodities have been rushed to market and the amount of commodity paper handled by this bank has been negligible. Cotton has brought the highest price in the history of the crop, and there was of cource no storage of the same to any extent. Early in the fall our board of directors appointed a committee, consisting of the three class B directors, to give special attention to the handling of the crop, and to encourage in every way the gradual marketing of farm products through the medium of commodity paper. There were few offerings of this class of paper, however, and our facilities in this respect were not availed of to any considerable extent.

As in all other sectiions of the United States, the trade acceptance system is in its infancy in this district, and there is much to be done before it will come into popular use. This bank has not handled this class of paper in any great volume. It has been the constant endeavor of the officers of the bank to popularize it and encourage wholesalers and retailers to put their book accounts into this form of negotiable paper. As will be noted in another part of this report, Cashier Talley delivered an address before the Credit Men's Association of Dallas in the early spring on the subject of "Trade acceptances", pointing out the advantages of the acceptance over book accounts and explaining some of the difficulties to be overcome before the acceptance could be generally adopted. The campaign in this regard conducted by the officers of this bank and other organizations has borne fruit, as is evidenced from the use of acceptances by some of the larger firms of the district. It is difficult to change customs long established, and especially is this true on account of keen competition and the eagerness of manufacturers and wholesalers to sell in volume to cover overhead expenses, and their willingness to accept open accounts on terms to suit the purchaser. We believe that when acceptances are freely used instead of book accounts, a general market will spring up for them and they will be sought by commercial banks seeking investments, regardless of the relations of the indorser to them. Our board of directors, on January 12, in an effort to encourage the use of trade acceptances, reduced the rate to 3½ per cent for 90-day maturities, the rate previously having been 3½ per cent for 60-day maturities and 4 per cent for 90-day maturities.

Believing that our members would welcome an opportunity for relieving their normal facilities of the tax that comes with the seasonal movement of our products, we have been accepting for immediate credit, subject to final payment, drafts with bills of lading attached and charging the low rate of 4 per cent interest for tho actual time outstanding. In this manner member banks are enabled to handle that class of business more economically than by the usual reduction of lending ability through the maintenance of compensating balances intended for the collection of such items. The total number of bill of lading drafts handled to December 30 was 1,442, classified as follows:

| Alfalfa products | $165,215.50 |

| Cotton products | 635,625.72 |

| Grain products | 256,964.09 |

| Other products | 129,968.20 |

| Total | 1,187,773.51 |

There is shown in the attached Exhibit E the amount of acceptances-trade and bank-discounted and bought by this bank during the past year; also the rates on this class of paper, and classification of the same by maturities. As mentioned in the paragraphs preceding, the acceptance form of credit instrument has not come into general use in the district. There is no question, however, that it will develop in time, when the advantages of acceptances as good negotiable paper are appreciated. Our board has endeavored to encourage the acceptance system by adopting as low rates for this class of paper as were consistent with safe investment.

The bank has not purchased any domestic acceptances, the paper bought being based on the importation or exportation of goods. The amount of acceptances bought from member and nonmember banks includes trade. acceptances discounted for members, and is shown in the attached table of that class of investments.

During the year there were bought in the open market $2,160,000 of United States bonds and $1,578,250 from member banks in addition to $425,000 bought during 1915 but not received until after January 1, 1916. Our transactions with the Treasury Department for the most part have been incident to the conversion of such securities. During the past year, in accordance with the regulations of the department, there were converted $1,412,400 of 2 per cent United States bonds into 3 per cent bonds and notes. No sales of bonds were made during 1916, and the bank's holdings at the present time consist of the following:

| 2 per cent consol bonds of 1930 | $2,923,350 |

| 2 per cent Panama bonds, series of 1906-36 | 542,500 |

| 2 per cent Panama bonds, series 1908-38 | 155,000 |

| 3 per cent conversion bonds, series 1916-46 | 707,400 |

| 3 per cent one-year Treasury notes, series 1916-17 | 705,000 |

| Total | 5,033,250 |

Of this amount, $2,000,000 represent bonds to secure the circulation of a similar amount of Federal Reserve bank notes.

Investment in municipal warrants were on a limited scale, and during the past year purchases of such securities have amounted to only $152,318 at rates ranging from 3 to 3 3⁄8 per cent. Distribution by maturities and issuing authorities is shown in the Exhibit F attached.

The reserve position of the bank has not varied materially during the year, except in the crop-moving season, when demand for accommodation was extraordinarily heavy.

Upon the granting by the Federal Reserve Board on February 25, 1916, of the petition of certain banks in Louisiana to be transferred to the Atlanta district and attached to the New Orleans branch of that institution, there were transferred to the sixth district 16 banks, reducing the capital of this bank by $69,450, together with a reduction of its reserve deposits by $141,513.36 and rediscounts by $9,858.24. This transfer became effective on April 27, 1916. There still remain 11 banks in the State of Louisiana which are members of the eleventh Federal Reserve district, and these banks seem to be entirely satisfied with the service rendered them by this institution.

In the early spring, one or two banks in the extreme Panhandle section of Texas petitioned the Federal Reserve Board to be transferred to the Kansas City district, claiming that the trend of business in their section was toward Kansas City and that on account of their geographical location they could be better served by the Kansas City bank. To offset this petition there were likewise presented letters and protests from many other banks in that section against this proposed transfer, and on the representations made that the Federal Reserve Bank of Dallas had in every instance served its member banks in the Panhandle in an acceptable manner, the Federal Reserve Board declined to consider the transfer.

Since January 1, 1916, there have been added to our membership 10 banks, increasing the capital stock of this bank by $24,250. There have been additional stock allotments of $15,350 to member banks on account of increase in their capital or surplus. Seventeen banks have liquidated and reduced the capital stock of this bank by $34,950. We have added to our membership in the past year one State bank, increasing our capital stock by $1,500.

The relation of the Federal Reserve Bank of Dallas to national banks, State banks, and trust companies, is one of extreme friendliness. Especially is this true of our member banks which we have served by rediscount. No efforts have been spared by the officers of the bank to impress on our members that each is a stockholder in the institution, that the Federal Reserve Bank is dedicated to service and that only through the loyal cooperation and support of its members could that end be attained. It has been the policy of this bank to invite and consider suggestions from its member banks and to have them feel that they were all welcome in the bank.

In line with the policy of the officers of the bank to keep closely in touch with our member banks and explain the. operations of the Federal Reserve system this bank has been represented at all of the district bankers' conventions as well as at various State conventions. Federal Reserve Agent Ramsey and Vice Governor Hoopes attended the meeting of the Panhandle bankers at Clovis, N. Mex., in June, where Mr. Ramsey made an address on the Federal Reserve system. Mr. Hoopes attended all the district meetings of the Texas Bankers' Association, and at Houston and San Antonio delivered addresses on the operations of the clearing system. Messrs. Ramsey and Hoopes also attended the conventions of the Texas State Bankers' Association at Houston in May, where they again had the opportunity of meeting a large number of Texas bankers and of discussing informally matters in connection with the Federal Reserve Bank of Dallas. In August of this year Mr. Hoopes was called into conference with bankers, business men, and planters of central Texas, held at Bryan; to consider ways and means of handling the unusually heavy cotton crop in that section. Mr. Hoopes assured this conference of the cooperation of the Federal Reserve Bank of Dallas, and its readiness to assist in every consistent way in the movement of the crop. In November Messrs. Ramsey and Hoopes attended the annual meetings of the State Bankers' Associations of Arizona and New Mexico, held at Phoenix and Albuquerque. At each of these meetings Mr. Ramsey spoke, and it is hoped that his address may have a good effect in clearing up some of the misunderstandings on the part of the bankers in those States on the collection system and rediscounting operations of this bank.

On January 5 there was issued to all State banks in the district a circular setting out the advantages of membership in the Federal Reserve system. The State banks for the most part are friendly to the system, and it is believed that when such banks come to realize that there is some moral obligation resting upon them to bear their part in making a unified banking mechanism they will come in, as, in any event, they are practically certain to do when more stringent financial conditions arise.

As has been stated in a preceding paragraph, this bank has been of real service to its member banks through the rediscounting operations and purchase of acceptances. In the exhibits attached, and previously referred to, there is shown the number of banks accommodated, amount of paper rediscounted, the volume of acceptances discounted and purchased, and the various other forms of investments made by the bank.

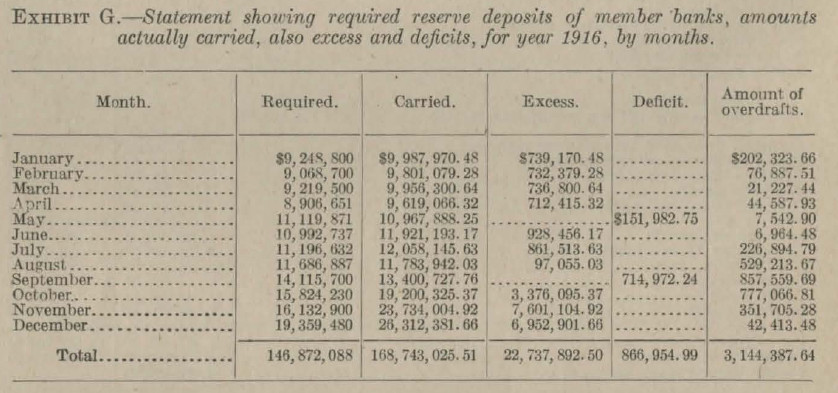

There is attached a statement (Exhibit G) showing the required reserve deposits of member banks, excesses carried, and amounts of overdrafts, by months, for the year 1916. The amount of such deposits on December 30 was $25,742,902.

There are compiled in our credit information department elaborate statistics and other data on the condition of member banks at the dates of the Comptroller's calls. All reports of examinations, furnished by the chief examiner, are carefully checked and memoranda made of any items or criticism or any irregularities reported.

We have had occasion during the year to make special examinations of three member banks, on account of items and transactions which appeared irregular, brought out through applications for rediscounts, or otherwise. In each instance the officer of this bank conducting the special examination has made report to the executive committee of the bank, and steps considered necessary were taken to correct the matters subjected to criticism.

During tho past year only one member bank has been closed by the chief examiner on account of insolvency. The bank in question has not been authorized to resume business, but its affairs are being liquidated, and our information is that there will be no loss to depositors. This bank was not involved in the matter, as the bank in question had no paper with us. One member bank closed by the examiner in 1915 was authorized to resume business in January of this year.

Overdue paper held by member banks and reported by examiners is made a matter of record in the credit files of our credit bureau. This bank held no overdue paper during the year.

The bank has not engaged to any large extent in open-market operations, and the scope of its activities in this respect has been the rather limited purchase of acceptances and municipal bonds and warrants. There are shown in an exhibit attached, and discussed in a preceding paragraph, the amounts of such securities handled. For the most part of the year there is sufficient demand upon the bank from its member banks to absorb a large portion of our loanable funds, and we have not, therefore, entered the open market seeking investments.

It is believed that the discount-rate policy of this bank has had the effect of softening and stabilizing interest rates to a large extent. The past year has been a rather easy one and interest rates have been lowered generally. It is believed that our discount rates have influenced in some degree the rates charged by member banks to their customers. It is probably true that central reserve and reserve city banks have reduced their rates to their correspondents to meet the rates of this bank, and this form of competition has caused some complaint against Federal Reserve Banks. However, our rates have been in substantial harmony with those of other Federal Reserve Banks, and, as a rule, not below rates prevailing in the East.

The newspapers of the district have been especially friendly to this bank, and through their cooperation and the assistance of various financial and trade Journals, as well as addresse& before the more important civic organizations, the bank has kept itself before the public. The officers of the bank have delivered several addresses before local organizations or clubs, and in each instance have been most cordially received, and it is believed much good has resulted from these discussions. Early in the year Cashier Talley addressed the Credit Men's Association of Dallas on "Trade acceptances." Later in the spring and at different times in the year Mr. Ramsey addressed the Builders' Exchange, Ad League, Electric Club, and Lions' Club on the Federal Reserve system, and more particularly on the different phases of the operations of tho DaJlas bank. It is the policy of the officers of the bank to give to the press any matters affecting the institution in which the public might be interested. The monthly letter issued by the Federal Reserve Agent's department on business conditions throughout the district has also been an effective means of keeping the bank before the public, and proven of great value in our publicity work. The letter is sent to all the important newspapers of the district, as well as to leading financial and trade publications. We have established a regular mailing list, and each month the report is eagerly sought by business interests throughout tho district.

The bank has acted as fiscal agent for the Government since January 1, handling various characters of funds, making transfers, etc. Through the local officials details were arrangcd for receiving the deposits and effecting transfers.

Government funds have been handled in accordance with regulations of the Treasury Department, and these and other transactions with the Treasury Department have been conducted without friction, delay, or the slightest inconvenience.

Our relations with the comptroller's office have be0n most agreeable and satisfactory. That bureau of the Government is so closely interwoven with the functions of Federal Reserve Banks, especially in connection with the affairs of member banks, that we are necessarily in close touch with that office, and all matters emanating from that bureau have received close attention.

In our opinion the second year's operations of the Federal Reserve Banks have had the effect of partially, if not entirely, removing the impression in the minds of officials of member banks that with its inception there was merely added another supervisory body in the conduct of their affairs. The system has clearly demonstrated by practical operation that this was not true; but, on the other hand, the banks have proven their ability to cooperate with their members and not only to be of material assistance in stressful periods, but in every way consistent with safe banking to eliminate "red tape" and unnecessary restrictions in the conduct of their business.

The policy of this bank in the issuance of Federal Reserve notes has been to provide member banks with sufficient currency to handle the crop movement and for legitimate demands generally in the conduct of their business and there could have been no better opportunity to test our facilities in this respect than that presented during the last crop moving season. The crop moved with a rush, caused by the high prices prevailing for cotton and farm products and within less than a week from the time the movement began the bank was called upon to meet unprecedented demands for currcency and silver. Never before in the history of the South has the crop brought such prices and certainly never has the crop moved with such rapidity. Owing to the extraordinary demand for currency it was necessary to forward telegraphic orders for additional Federal Reserve notes, and for a time it seemed as if the supply in the hands of the Federal Reserve Agent would be entirely exhausted. Fortunately, however, we were able to meet the emergency. In this connection a statement showing the issues of Federal Reserve notes, by weeks, for the months of August, September, and October, the height of the crop movement, may prove interesting:

| Week ending | |

|---|---|

| Aug. 5 | $235,000 |

| Aug.12 | 80,000 |

| Aug.19 | 1,316,750 |

| Aug. 26 | 1,000,000 |

| Sept. 2 | 4,542,000 |

| Sept. 9 | 200,000 |

| Sept. 16 | 360,000 |

| Sept. 23 | 2,260,000 |

| Sept. 30 | 1,220,000 |

| Oct. 7 | 1,340,000 |

| Oct. 14 | 500,000 |

| Oct. 21 | 300,000 |

| Total | 13,353,750 |

There is also attached a statement (Exhibit H) showing the transactions in notes from the organization of the bank to date.

The bank realizes the advantages of conserving the gold supply and impounding it against the issue of Federal Reserve notes. As the volume of our rediscounts was insufficient to cover, gold has been deposited with the Federal Reserve Agent as cover for a large portion of the bank's Federal Reserve notes now outstanding. Especially has the substitution of gold for rediscounts been necessary during the latter part of the year, with the heavy decrease in our loans. This exchange has materially strengthened the bank's position. The amount of notes outstanding has varied throughout the year, reaching the highest mark on October 18, 1916, of $25,890,000 and the minimum of $13,555,000 on February 21, 1916.

As stated in the preceding paragraph gold has been deposited by the bank to a very large extent against the issue of Federal Reserve notes. Rediscounts received by the bank, while of large volume, have never been sufficient to cover the amount of Federal Reserve notes required to be issued, and against this excess gold had to be deposited.

In the attached table (Exhibit H) there are shown the denominations of Federal Reserve notes issued. Notes of the smaller denominations are in greater demand and, as the figures indicate, are issued in considerably larger number than notes of the higher denominations. The larger notes were used quite extensively during the past season in shipments to member banks to cover exchange drawn by their correspondents.

The movement of Federal Reserve notes between this bank and other Federal Reserve Banks is largely made up of notes returned to this bank. There have been returned by us in 1916 notes of other banks aggregating $853,295, while the amount of notes of this bank returned to us by other Federal Reserve Banks was $4,314,760. This will indicate the movement and show that approximately five times as many notes of this bank are received from other Federal Reserve Banks as are returned to the latter. On February 10 we issued a circular to member banks requesting them to separate Federal Reserve notes and send them to us against transfers to their northern and eastern correspondents instead of shipping the notes to make exchange. This action was taken on account of the very heavy expense to this bank for transportation charges. The circular had a good effect and resulted in a saving to this bank.

In accordance with section 18 of the Federal Reserve Act, the bank has taken out $4,000,000 in Federal Reserve bank notes against United States bonds. Of the total, two millions were placed in circulation during the crop moving season, but the bank's liability on these notes has since been extinguished through the deposit with the United States Treasurer of $2,000,000. The other two millions are held by the bank at the present time.

The Federal Reserve Agent, as the representative of the Government and the Federal Reserve Board, has issued Federal Reserve notes to the bank upon application against rediscounts or the deposit of gold. It is the practice for the bank to pledge daily with the Federal Reserve Agent all the rediscounts received and against the same to take out notes as needed, the rediscounts being taken down as they mature.

There have been held during the year 1916 twelve directors' meetings, at the majority of which there was a full attendance of the board. All of the meetings have been in perfect harmony, and the three classes of directors have at all times worked for the best interests of the bank and discussed its operations in the frankest manner. Our board of directors is truly representative of the financial and business interests of the district, and it would be difficult to find a more equally balanced body. As provided by the by-laws, the board has appointed at each of its monthly meetings the third member of the executive committee, to serve with the governor and Federal Reserve Agent. The third member of the committee has been selected from class A and class B directors, and while, on account of distance and inconvenience in attending daily meetings of the executive committee and passing on offerings, it has not been possible for him to be present all the time, he has attended a large number of the meetings and assisted in the work of the committee.

In the death, on March 22, of Class C Director Felix Martinez, of El Paso, our board lost one of its valued members and a true friend of the Federal Reserve system. While Mr. Martinez found it impossible to attend many of the meetings, on account of his large personal interests and the further fact that his residence was so far removed from Dallas, yet he was ever loyal to the interests of the institution and his colleagues on the board found his counsel invaluable. On April 17 the Federal Reserve Board announced the appointment of Mr. H. 0. Wooten, of Abilene, Tex., as class C director to fill the vacancy caused bJ the death of Mr. Martinez.

The terms of office of Class A Director B. A. McKinney, of Durant, Okla., and Class B Director Marion Sansom, of Fort Worth, Tex., expired on December 31, 1916. In accordance with the Federal Reserve Act and the regulations of the Federal Reserve Board, steps were taken looking toward the holding of an election for the successors of these two members of our board. Director McKinney was originally elected by banks in group 3, and Director Sansom was elected by banks in group 1. In conducting the election of the past year, the banks of the district were Tegrouped in ordeT that each group might contain, as nearly as may be, one-third of the member banks. The necessary circulars, lists of nominees, ballots, etc., were furnished the member banks and the district reserve electors, and on November 21, the date set by the Federal Reserve Board, the polls opened for the filing of ballots. The result of the election was announced on December 6, and Messrs. McKinney and Sansom were both reelected to serve for the three-year term beginning January 1, 1917. As in previous elections conducted in the district, only a small number of banks entitled to vote exercised that privilege. Especially was this true in the latest election among banks in group 3, which contains banks with the smallest capitalization. It is to be regretted that member banks take so little interest in these elections. Any change in the present method, however, could only be accomplished by an amendment to the Federal Reserve Act.

On January 6 the Federal Reserve Board am1ounced the acceptance of the resignation of Mr. E. O. Tenison, Federal Reserve Agent, and the appointment of Mr. W. F. Ramsey, of Austin, Tex., as his successor. Mr. Ramsey executed the oath of office and the transfer of assets of the department to him was made on January 15, 1916. The Federal Reserve Agent's department was conducted from that time until July 3, 1916, by Mr. Ramsey, with the assistance of his secretary, Mr. Charles C. Hall. On July 3 Mr. Hull was appointed assistant to the Federal Reserve Agent, and assumed his duties as such. All transactions between the Federal Reserve Agent's department and the bank, including the receipt and delivery of Federal Reserve notes, the routine work of the department, the preparation of daily, weekly, and monthly reports, compilation of data and statistics for the monthly business letter, etc., are handled by the assistant to the Federal Reserve Agent, under his direct supervision.

In the early part of the year the Federal Reserve Board abolished as an active position the office of deputy Federal Reserve Agent. Prior to that time, and since the bank was opened, the position had been an active one in this bank, and the deputy Federal Reserve Agent drew a regular salary as such. With the ruling of the board that the class C director designated as vice chairman of the board and deputy Federal Reserve Agent should merely receive the fee of a director when attending board meetings, and preside in the absence of the Federal Reserve Agent, that policy has been followed during the past year. Mr. W. B. Newsome, of Dallas, was on February 10 appointed as class C director and designated as vice chairman and deputy Federal Reserve .Agent. In the absence of the Federal Reserve Agent, Mr. Newsome has assumed charge of the department and served on the executive committee with ability and advantage to the board.

Upon the resignation of Mr. J. Howard Ardrey as member of the Advisory Council for the Eleventh Federal Reserve District, the board of directors considered the selection of his successor. After careful consideration of the names presented, the board on January 7 elected Mr. T. J. Record, president of the City National Bank, of Paris, Tex., as the member of the council from this district, and Mr. Record has served as such throughout the year. Mr. Record has attended all of the sessions of the Advisory Council, and has kept in close touch with the affairs of the bank, the business and financial development and the needs of the district. Upon invitation of our directors, he has been in attendance at many of our meetings and addressed the board on matters affecting the good of the bank, the eleventh district, and the Federal Reserve system generally.

There have been few changes in the personnel of the officers and heads of departments of the bank in the past year. On January 7 Mr. Sam R. Lawder was appointed assistant cashier, a recognition of meritorious service since the bank was established. Mr. Lawder prior to this appointment was manager of the credit department, which work he now supervises in a general way. The details of the credit department, however, are managed by Mr. R. R. Gilbert. This department is accredited to the Federal Reserve Agent's office, and in this connection it is gratifying to report the excellent work accomplished by the credit bureau in the past year. By the careful analyses of credit statements and the compilation of statistics from statements of member banks and the copies of reports of examination the credit files of the bank have been developed to a high state of efficiency, and the work being done in that department is worthy of commendation. Indeed, Federal Reserve Examiner Broderick in his examinations of the bank has seen fit to comment on the efficiency of our credit bureau. There is no conflict of authority between the Federal Reserve Agent's department and the banking department proper. Both branches of the institution have worked harmoniously, and, with the duties and responsibilities of each defined, there is no reason why this should be otherwise.

In this connection it may be mentioned that the auditor of the bank makes a semimonthly audit of the teller's cash nnd a monthly audit of the vault cash, also a monthly audit of the lonn department, and in addition to this keeps a continuous audit of Federal Reserve notes and gold covering the same in the hands of the Federal Reserve Agent. It is the practice for the auditor to be present at all entrances into the vault for the purpose of delivery or receipt of Fedmal Reserve notes between the bank and the Federal Reserve Agent's department; and in addition to this vault control a representative of the bank proper-either the vice governor, cashier, or assistant cashier-is also present when the vault is entered. All compartments in the main bank vault used by the Federal Reserve Agent are under double combinations, one combination being held by the Federal Reserve Agent and his assistant, the other by the officials of the bank proper. This vault control has been very favorably commented upon by the Federal Reserve Bank examiner.

With the acquisition by the bank of its present quarters in the latter part of 1915 the institution has ample office and vault facilities. The hank looked ahead in the planning of the new structure and provided well for the future. Even with the inauguration of the district clearing-house department of the bank on July 6, 1916, and the addition to the force of some 20 men, together with the necessary equipment for the proper conduct of the department, the present building has afforded sufficient space without inconvenience. It is interesting to note that, on January 1, 1916, the force of the bank, office~ and employees, numbered 31, whereas on December 31, 1916, the force numbered 63. This increase has been made necessary not only by the inauguration of the clearing system, which increased the work, particularly in the bookkeeping and auditing departments, but also on account of the increased work in the other departments of the bank.

During the present year the bank proper has been examined once by the Federal Reserve examiner and his staff. In addition to this, the Federal Reserve Agent's accounts were examined by representatives of the Federal Reserve Board on January 15, May 8, August 8, and December 10, 1916. It may be stated in this conneetion that in all of these examinations there were but few matters subject to criticism, and such as were reported by the examiner and called to the attention of the officers of the bank were immediately corrected.

The voluntary, or optional, clearing plan inaugurated June 1, 1915, which contemplated the reciprocal clearing of checks at par through this bank, was not generally used and proved unsatisfactory.

That the reserve city clearing house of the Federal Reserve Bank of Dallas has fulfilled expectations and is serving the commercial and banking interests of the eleventh district more expeditiously and economically in the settlement of balances than could have been done under conditions existing before its installation is, in the opinion of those most vitally interested, admittedly a matter of fact, as shown by the extracts from letters received from the officers of the participating banks.

In order that the experience gained in the eleventh district through the operations of this department may be made known, a review of its development seems appropriate.

During the month of November, 1915, the cashier of the Federal Reserve Bank of Dallas, Mr. Lynn P. Talley, who for many years had been in daily touch with the unscientific and unsatisfactory methods employed in settling balances between the banks in the reserve cities of this district, offered to the reserve city member banks a plan for settling balances with each other daily through the Federal Reserve Bank which would not entail the float of large amounts of money in tramsit between these banks, or needless expense, and which would make unnecessary the waste of time and energy by the officers of the banks.

Following this proposal, on December 21, 1915, about 20 representatives of the banks met in Dallas and, after a discussion of the merits of the plan, decided that, with slight modifications, it be given a thirty-day trial. The trial period was subsequently extended to March 1, and thereafter the clearing house became one of the permanent facilities of the Federal Reserve Bank. However, at the time that general clearing operations were undertaken between all member banks, on July 5, the reserve city clearing house was discontinued, because it was thought that the general clearing plan would have the effect of making it superfluous. Those banks which had participated in the plan speedily make it known, however, by means of a post-card vote on the question, that it was their desire that the reserve city clearing house be continued, and it was opened on July 12.

Under its operations the advantages are extended to 27 banks in the cities of Fort Worth, Waco, Houston, Galveston, San Antonio, and Dallas, only five banks not availing themselves of its benefits. By mutual consent one other member, though not located in a reserve city, has been added.

The members of the clearing house continue to send the actual checks and drafts which they receive on each other to the drawee banks for credit, and against these sendings, in round amounts, they draw a draft in favor of the Federal Reserve Bank and forward it to that bank for credit in the reserve city clearing house. The aggregate amount of all drafts assembled against each bank is debited on a clearing sheet and the amount of their letters which were made up of items on other members is credited, leaving either a debit or a credit balance to be settled.

In this way the amount of float is reduced materially by off-sets, and at times certain banks, through cancellation of debits agninst credits, come out exactly even, and frequently banks settle hundreds of thousands of dollars with the actual transfer of a few thousand. The results of the clearings are telegraphed to the managers of the local clearing houses in each city by special code each day at 11:45 a. m., and the separate banks are notified. Settlements must be made on tho date the clearings are effected and the Federal Reserve Bank advised in special code by telegraph, or, in some instances, by telephone, of the manner of settlement, not later than 3 o'clock p. m. Debit balances may be covered in any of the following ways: Debited to the reserve account of the debtor bank; remittances by mail to any other Federal Reserve Bank, for the credit of the Federal Reserve Bank of Dallas, at the prevailing rate of exchange; arrangement with any other bank to deposit funds with the Federal Reserve Bank for that purpose; and remittance of currency by registered mail insured. In the event that the latter option is chosen, the cost is assessed ratably against the banks which forwarded the items which caused the debit balance. In the absence of advice, debit balances in the district clearing house are charged to the reserve account. Disposition of credit balances is subject to the instructions of the creditor banks, and, in the absence of advice, are credited to the reserve account. Quite often the balances received by various banks in one of the cities are traded between themselves, making transfers or currency movements useless, and obviating the attending expense.

Participating banks may, if they prefer, send the items direct to each other, taking a carbon copy of the cash letter, which, when certified by an authorized officer or employee, may be sent to us and becomes, in effect, a draft against tho bank to which the items were sent, the amount of which is credited to the sending hank.

Since general clearing operations have become effective, the members of the reserve city clearing house have found this department a distinct benefit to them, in that it makes the drafts which their correspondents draw on them eligible for immediate credit with the Federal Reserve Bank. Drafts of this character are, by arrangement with the drawee bank, stamped "Charge (drawee bank) in reserve city clearing house." This method of covering items which we have sent to members not in reserve cities has been used extensively, as the following figures testify:

| Amount | Average Daily | |

|---|---|---|

| July 5 to Aug. 1 | 985,772.74 | 49,299.63 |

| Month of August | 4,436,843.67 | 184,868.48 |

| Month of September | 9,823,467.47 | 392,938.69 |

| Month of October | 12,051,242.85 | 502,135.12 |

| Nov. 1 to 25, inclusive | 9,853,469.16 | 469,212.81 |

| Total | 37,150,795.89 | 1,598,443.73 |

Items handled under this arrangement are listed on a separate letter and sent to the Federal Reserve Bank, and are cleared against the drawee banks, with a resultant credit of the entire amount to the Federal Reserve Bank of Dallas, which participates in the clearings to that extent and receives acceptable funds in payment from the other participating banks.

It may be interesting to note that, on the opening day, December 28, 1915, the total clearings were $1,175,000, with ensuing balances of only $484,000, showing offsets of $691,000, while on October 18, 1916, the total clearings were, in round figures, $7,000,000, with ensuing balances of only $1,109,000, showing offsets of $5,891,000.

The aggregate amount cleared through the reserve city clearing house from the opening day, December 28, 1.915, to November 5, 1916, indusive, was, roundly, $486,000,000, which Wild settled with balances of only $141,000,000. The settlement of these balances entailed only the shipment of currency in the aggregate of $8,300,000.

The bookkeeping employed is simple, and each account is closed at the end of the day's business. Drafts cleared against the banks are stamped "Cleared through the reserve city clearing house (date)," and become debits to an account with each bank termed "Reserve city clearing house accounts," the letters received from the banks become the credits, and the difference is settled in one of the ways indicated above. Statements are rendered each day and are accompanied by the drafts which have been cleared. A composite statement of the whole clearing operation is each day rendered to all of the members of the reserve city clearing house, which shows the resulta of the clearings hy bank, debits, credits, and balances.

It is, therefore, apparent from the foregoing that what was termed at its inception an experiment has, through the knowledge born of Mr. Talley's large experience in this field and study of the principles involved, proven to be a permanent betterment.

On July 6, after much preliminary work in devising forms, systems, etc., and circularizing member and nonmember banks, the district clearing house began receiving items from our member and nonmember banks within the district, and on July 15 took on interdistrict clearing operations in their entirety, in accordance with Federal Reserve Board Circular No. 1, series of 1916. Owing to the unfamiliarity of new clerks with new methods and the fact that from the start items were received in increasing volume, there was for some time a good deal of confusion and the department was frequently kept at work until the early hours of the morning. This condition gradually improved until at the present time the mail is seldom deposited in the post office later than six o'clock p.m., which practice is necessary to the success of the system, as member banks can not receive the items and return funds covering the amount of debit balances in the district clearing house on schedule time unless our outgoing letters leave on the early evening trains.

It is probable that more opposition from both member and nonmember banks to establishing clearing operations was felt in this district than elsewhere, and the fact that practically all of the items handled by us have come from reserve city banks and from or for the account of other Federal Reserve Banks has prevented us from demonstrating that the principle of a clearing house at a central point which offsets and cancels the balances which have been caused between banks by the commerce of the district is correct. As has been shown by the operation of our reserve city clearing house, if each bank sent all of its outside items to the district clearing house and received from the district clearing house all of the items drawn on itself which come from outside sources, the cancellation of debits against the credits should eliminate from 75 to 90 per cent of the amount of float necessary under the methods previously employed and would result in a vast saving to the banks.

The Federal Reserve Bank of Dallas has pursued a very liberal policy toward its members in the clearing operations and has given them immediate credit on items drawn on banks in all Federal Reserve cities. During the months of September, October, November, and December the approximate amount of float carried by reason of this practice has averaged $914,062 daily, but it was felt that, for the time being at least, some method for the immediate settlement of the balances caused by our sendings, other than by the shipment of currency or coin, should be allowed the banks. In addition to accepting Federal Reserve city exchange, the drafts of country banks on Texas reserve city banks have been placed on the same basis as those drawn on Federal Reserve city banks, by permitting them to be made payable through the reserve city clearing house, thus making them eligible for immediate credit at the Federal Reserve Bank. That this facility has been of great value is evidenced from larger amounts of such items cleared which, during the months of September, October, November, and December, averaged approximately $445,000 daily. We have also received from member banks since the inauguration of the system shipments of currency, gold, and silver, at an expense borne by the district clearing house, to cover debit balances received by them, roundly, $2,841,982, at a cost of approximately $1,310.49, or $0.461 per thousand. In explanation of the apparent high average cost, it should be considered that many of these shipments were in small amounts and of a mixed character, and the total includes gold and silver coin, whieh has advanced the general average cost.

The largest proportion of items handled on the deferred basis has been on member banks, of which there were, since opening of the district clearing house, July 6 to December 30, 1,193,459, aggregating $164,274,799. Of this 530,776 items, aggregating $76,654,028, were received from or for the account of other Federal Reserve Bnnks, and 662,673 items aggregating $87,620,771 from our member banks. Items received from member banks on outside districts numbered 30,444, amounting to $6,164,775. The volume of items on Dallas received from or for the account of other Federal Reserve Banks was 97,054, aggregating $42,557,485, and 22,107 items on Dallas, amounting to $54,675,102, were received from member banks. The number of nonmember banks in the eleventh district which we have been able to include in our par list has not come up to our expectations. There were originally 219 banks on this list, while at the present time this number is only 218.

The amount of this class of items sent direct was $3,160,946 and numbered 51,191, while the amount cleared through member banks was $10,730,925 and numbered 101,159 items. Of these 42,265 items, aggregating $4,862,946 were received from or for the account of other Federal Reserve Banks, and 58,894 from member banks, in the amount of $5,876,979.

The expense of the department has shown no appreciable increase since the beginning, while the volume of items handled has practically doubled. This enabled us to announce that, beginning November 1, the service charge would be reduced from 2 cents to 1½ cents per item.

Though the volume of items handled has practically doubled since the beginning, this increase has not continued since the month of September, during whole month we handled approximately the same number of items as we are handlihg at the present time. It has therefore seemed that, under present conditions and the system employed, the operations of this department are at their maximum. The explanation of this seems to be that in this district the country banks, having abnormal excess amounts of cash and exchange, and demand for money being less than the supply, feel it to be impractical to handle the items through the Federal Reserve Banks and absorb the service charge when they can send the items to their correspondent reserve city banks, count the proceeds as reserve the day the items leave their offices, receive immediate credit for them on receipt, and draw interest on the balances created, with no attendant cost for handling. On the other hand, the banks in the centers feel that, even with the cost otherwise being equal, they would rather send their items direct to banks which have accounts with them. In this manner they would continue the friendly relations which have heretofore resulted in increased business from other sources, by extending with profit to themselves, to allied country banks, facilities not contemplated by the Federal Reserve Act. It is also necessary for commercial banks in the centers to maintain an equipment to handle business which they receive from and on nonmember banks, which in volume is considerable, and to which the added business received from national banks carries no proportionate additional expense.In some cases, according to information received, the collection cost on checks to individual depositors has been reduced, but on others it has been increased, and an analysis of the business of the banks handling probably the largest commercial business in the district has shown that the expense to their depositors on a whole would be, in the aggregate, about the same under a system of service charges which allows an additional cent per item to the bank which receives the items as it would under the old cost method based on the amount of the items.

The service rendered to this bank by the gold settlement fund has been of great value in our settlements with other Federal Reserve Banks, and in the relations between the bank proper and the Federal Reserve Agent. In our opinion the gold settlement fund has proven a very effective means of settling balances in all parts of the United States.

·The operations of this bank for the past year have been, for the most part, entirely satisfactory. The fact of its existence has everywhere engendered and maintained a spirit and feeling of assured confidence and has dispelled any fear which might otherwise be entertained of the danger of financial distlirbances. Its growth in public favor is manifest on every hand. This growth has increased, and will continue to increase, as the basic principles of the system become better understood.

The operations of the Federal Reserve system have assured an adequate supply of money for the needs of legitimate business of the country. Our own operations have shown that with seasonal developments the money supply has responded to the needs of legitimate commerce, and has been adequate to meet the demands of the most exceptional seasons.

This attitude of the Federal Reserve Banks, as well as the policy of the Federal Reserve Board, of assembling and maintaining large reserves of gold have tended to reassure even the most critical that the integrity of our financial system will under all circumstances be preserved. Our operations, as well as what we think are our reasonable requirements, have tended to insure better business methods among bankers and especially have rendered very general the use of credit statements by all borrowers. It is also true that the banks, as a rule, as they have become more familiar with the requirements of the Federal Reserve Bank, have taken especial pains, not only to better secure their loans, but to insure, in respect to them, a larger measure of liquidity. The provision of the Act for acceptances by banks in aid of exportation and importation of merchandise has been availed of to some extent, and will in the future prove of great advantage, not alone to the banks but to the commerce of the country. We have met with a fairly liberal response on the part of our member banks in our effort to build up our supply of gold, and the excess deposits of member banks carried with us in the aggregate amount to a very substantial sum. It has been our observation that as the banks in the district have studied the Federal Reserve Act and have become more familiar with the methods and operations of this bank, that they have become better satisfied, and a large part of the antagonism toward the Federal Reserve system, which existed a year ago, has disappeared. Many of the most conservative banks in our district which have never borrowed money from anyone feel a special relief in the knowledge that the means for relief are at hand, if needed, and in the fact of the certainty of such aid is found a strong assurance against unwise and unnecessary withdrawal of balances by their depositors.

The year has been one of great prosperity to the banks of this country, and while there has been some recession of interest rates over the district, this decrease in rate of return on loans has been more than compensated by a heavier volume of business.

The collection system, which has engendered very acute and active opposition in this district, is progressing with very satisfactory results. We have sought to so administer the Act of Congress, in harmony with the regulations of the Federal Reserve Board, as to impose as little burden as possible on our member banks and to bring to them all the benefits which this system can give. There are evident signs of some diminution of resentment or opposition to the collection system, and it is believed that a thorough and fair trial of it may ultimately satisfy most, if not all, of our member banks.

The demand for money in this section at this time is nominal. None of our banks, except a few in the cattle-raising sections, are rediscounting with us at present. Their demands are both seasonal, and so far have been very moderate.

The members, as a whole, have been quick to grasp the benefits which may be derived by them through our shipping facilities, and our coin and currency shipments in 1916 were nearly treble those of the previous year, and consisted of $1,413,700 in one and two dollar bills, $42,350,760 in other currency, $595,510 in silver dollars, $1,043,382 in fractional silver coins, and $123,900 in nickels and pennies, or a total of currency and coin shipments of $45,527,252.

At one time, during the height of the cotton movement, when transportation difficulties made future shipping uncertain to a marked degree, the bank proved beyond question its usefulness to its members, and during that one week shipments amounting to $5,062,545 were made. It was at that time that it became propitious to put in circulation $2,000,000 in Federal Reserve Bank notes secured by United States bonds. The bank's liability on these notes has since been extinguished through the deposit of an equal amount of lawful money with the Treasurer of the United States.

On shipments of Federal Reserve notes which otherwise would be sent outside the district for the purpose of creating exchange, we have agreed to assume the cost of transportation to Dallas when we make the transfer ourselves at prevailing rates of exchange. We have also agreed to pay the transportation cost on gold certificates sent us from the vaults of member banks. All shipments upon which we absorb the cost must be made by registered mail, insured under our policy.

EXHIBIT A.-Statement of earnings and expenses of the Federal Reserve Bank of Dallas for the year 1916 and since organization.| Earnings for 1916 | $306,874.64 | |

| Expenses | 122,550.20 | |

| 184,324.44 | ||

| Less depreciation | $16,000.00 | |

| Less difference account | 1.00 | |

| Less counterfeit | 5.00 | |

| Less exchange | 1,713.54 | |

| Less comission paid | 558.58 | |

| 18,278.12 | ||

| Net Earnings | 166,046.32 | |

| ========== | ||

| Earnings Since Organization | 552,316.29 | |

| Less Expenses | 291.834.05 | |

| 260,482.24 | ||

| Less Depreciation | 16,000.00 | |

| Less Difference Account | 1.00 | |

| Less Counterfeit | 5.00 | |

| Less Exchange dr | 1713.54 | |

| Less Commission Paid | 558.58 | |

| 18,278.12 | ||

| 242,204.12 | ||

| Less Dividends Paid | 200,302.19 | |

| Cr. Balance, Jan. 1, 1917 | 41,901.93 |

EXHIBIT C.-Discount operations of the Federal Reserve Bank of Dallas, Tex., for the year 1916.

| Total number of banks accommodated by rediscount in 1916 | 301 |

| Total amount of discounts for member banks in 1916 | $18,512,542.85 |

| Number of new banks served in 1916 | 301 |

EXHIBIT D.-Classification of member bank discounts handled, by maturities, in 1916.

| Due in 10 days | $77,000 |

| Due after 10 but within 30 days | 1,404,467 |

| Due after 30 but within 60 days | 4,077,083 |

| Due after 60 but within 90 days | 6,689,999 |

| Due after 90 days | 6,263,993 |

EXHIBIT E.-Amount of acceptances-trade and uankers'--discounted and bought by the Federal Reserve Ba_nk of Dallas in 1916.

| Trade acceptances discounted | $248,934.71 |

| Bankers' acceptances bought in open market | 3,543,046.71 |

| MATURITIES OF TRADE ACCEPTANCES DISCOUNTED | |

|---|---|

| Thirty days | $35,555.19 |

| Sixty days | 167,726.94 |

| Ninety days | 45,652.58 |